Likewise, H&R Block and TurboTax have a user satisfaction rating of N/A% and 98%, respectively, which reveals the general satisfaction they get from customers. Even better, get in touch with a current user of the software and ask for their opinion about the solution in question. Jan 26, 2018 TurboTax vs. H&R Block: Price. H&R Block is generally the less expensive of the two. TurboTax’s top-tier, throw-it-all-at-us version costs well over $100 at list price when you add in a state.

The start of a new year means it’s time to file your federal tax return. Many people stress about filing taxes but there are a number of tax filing services to make the process easier. Two of the most well-known services are H&R Block and TurboTax. They both offer a friendly user experience. They provide information along the way so you understand what you’re doing. And they both offer affordable filing options. Which of these services should you use when you file your 2019 taxes?

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

A Quick Look at H&R Block

H&R Block has provided consumer tax filing service since 1955. It’s become one of the most popular filing services since then, because it combines simple tools and helpful guidance. That’s useful whether you’ve never filed taxes or whether you’ve been filing for decades. Of course, tools and guidance come at a price. H&R Block currently offers four digital (online) filing options. You can see the options and pricing in the table below.

| H&R Block Filing Options | ||

| Filing Option | Costs | Features |

| H&R Block Free | Federal: Free State: Free | Best for new filers or simple tax returns; supported forms include 1040 with some child tax credits |

| H&R Block Deluxe | Federal: $49.99 State: $36.99 | Best for maximizing your deductions; includes all free features plus forms for homeowners; allows you to itemize |

| H&R Block Premium | Federal: $69.99 State: $36.99 | Best for investors and rental property owners; all More Zero and Deluxe features, plus accurate cost basis; Schedule C-EZ, Schedule D, Schedule E, Schedule K-1 |

| H&R Block Self-Employed | Federal: $104.99 State: $36.99 | Best for small business owners; all Free, Deluxe and Premium features, plus Schedule C |

The cheapest filing option is the free option. It lets you file your federal return and all state returns for free. The catch is that this options works for just basic returns. The major forms that it supports are the 1040, Schedule EIC for the earned income tax credit and Schedule 8812 for the Additional Child Tax Credit. You can also use this form with some other common tax forms: Form 1099 (B, DIV, INT and R), 1098 (E and T) and 1095 (A and B). Filing other forms will require you to upgrade to a paid plan.

Paid plans range from $49.99 to $104.99 for federal filing. All state filing costs $36.99 per state, with the paid plans. Most filers can get away with the Deluxe option, which costs $49.99 and includes software for maximizing tax deductions. If you do freelance work or own a small business, you’ll likely need to upgrade to the Self-Employed plan, which costs $104.99. Despite these listed prices, H&R Block frequently runs sales, especially during tax season.

One standout feature for H&R Block is its physical stores. If you don’t want to file your return online, stop by one of its 10,000+ tax offices in the U.S. The tax professionals there will be able to walk you through your filing. Filing in person starts at $69 for federal returns. Alternatively, you can work with an H&R Block tax professional without visiting a store by paying for the Tax Pro Go service, which allows you to upload your tax documents and then have a tax pro do the work for you. There’s also Tax Pro Review, a paid service where a tax professional will review your return for you before filing.

A Quick Look at TurboTax

H&r Block Tax Software Vs Turbotax Mac Download

TurboTax has been around since the mid-1980s. Part of its popularity is due to the fact that it’s owned by Intuit. Intuit also makes a software called Quickbooks, which millions of companies use to manage their accounting. But TurboTax is also popular because it offers a user-friendly design and straightforward step-by-step guidance.

Like H&R Block, TurboTax has a free filing option that allows you to file your federal return and one state return at no cost. However, the free option only supports simple returns with form 1040. If you want to itemize your deductions with schedule A (or if you need to use any other forms), you will need to upgrade to a paid plan. There are three paid plans that run from $60 to $120 for federal filing. State filing is always $45 per state, with paid plans. The free option includes one free state return.

| TurboTax Filing Options | ||

| Filing Option | Costs | Features |

| TurboTax Free Edition | Federal: Free State: Free | Best for simple returns using Form 1040; Comes with useful features like easy import, error check, refund explanations, deductions for dependents |

| TurboTax Deluxe | Federal: $60.00 State: $45.00 | Best for homeowners and for maximizing deductions; Comes with all previous features, plus charitable donations calculator |

| TurboTax Premier | Federal: $90.00 State: $45.00 | Best for investors and rental property owners; Comes with all previous features, plus focus on investment and rental property income, accurate stock reporting, refinancing deductions |

| TurboTax Self-Employed | Federal: $120.00 State: $45.00 | Best for self-employed, independent contractors, freelancers, consultants and small business owners; Comes with all previous features, plus access to self-employment tax experts, maximizing business deductions |

As with H&R Block, TurboTax’s free option supports the 1040 with some child tax credits. The Deluxe option will be enough for most filers. It costs $60, which is $30 more than the Deluxe option from H&R Block. You get slightly more features for that additional cost, however. Small business owners and self-employed individuals will need to upgrade to the Self-Employed option, which costs $120 for a federal return. TurboTax also frequently runs sales on its services and products during tax season.

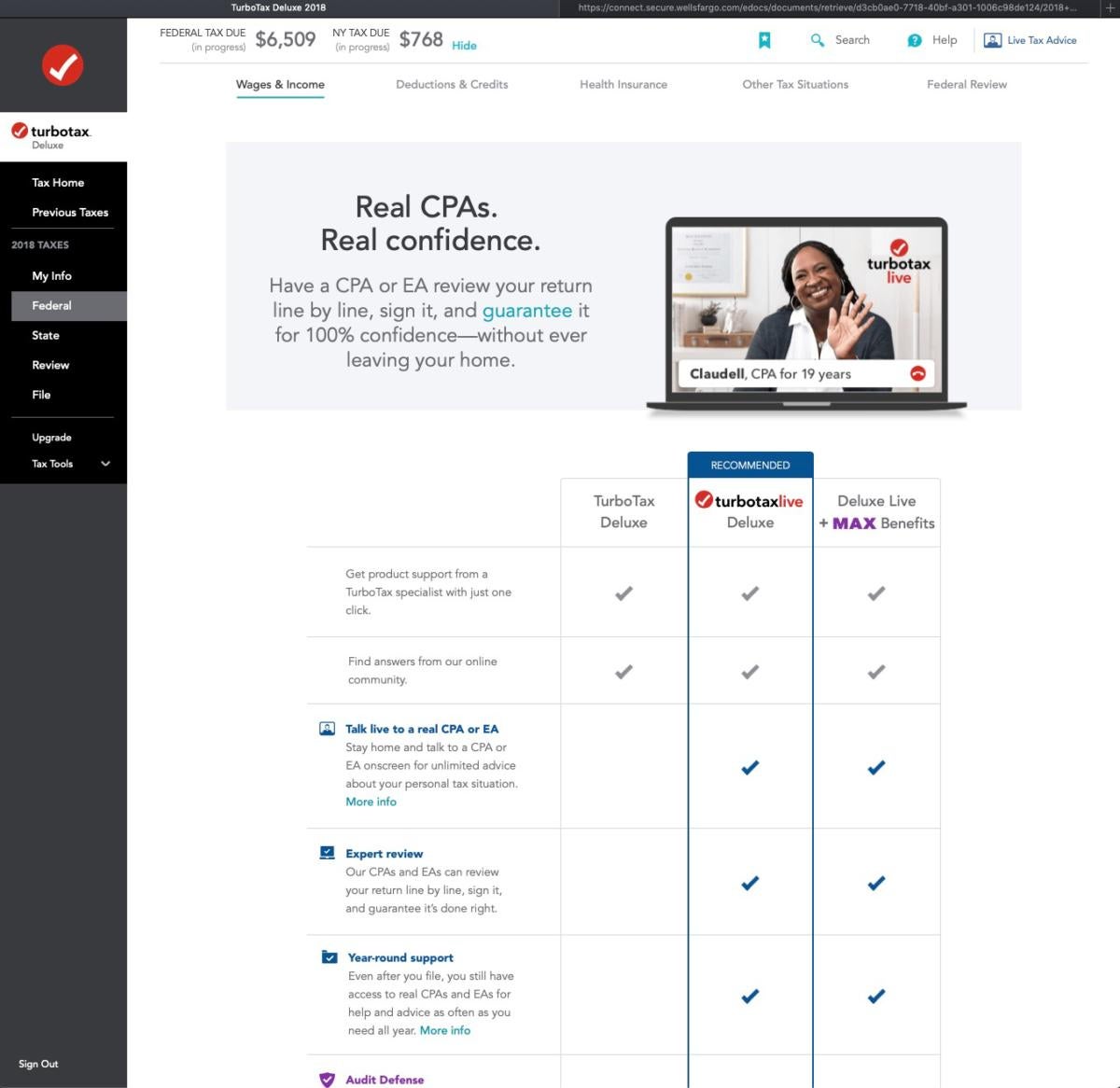

TurboTax doesn’t have any physical locations like H&R Block, but it does provide access to tax experts (CPAs or EAs). It will cost extra for you to get access to an expert, but there are four plans available, corresponding to the four plans listed in the table above.

H&R Block vs. TurboTax: Cost

Cost is always a consideration when you choose a tax filing service. H&R Block and TurboTax are the two most comprehensive online services available and likewise they are also the most expensive.

As mentioned, both services offer a free option, covering simple returns. You can also file some additional schedules and forms with this option. However, H&R Block does cover more forms and schedules with its free option. It also allows you to file multiple state returns for free. By contrast, the free plan from TurboTax includes only one free state return. This all gives H&R Block a slight advantage if you qualify for the free option. (You can read more about the free options in the next section.)

It’s great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat.

There are a couple of big differences between the options in the forms that they support. TurboTax’s Deluxe option supports Schedule SE, which allows you to file self-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

The cheapest H&R Block option that supports Schedule SE and C-EZ is Premium. That will cost $49.99 (versus TurboTax’s Deluxe option, which is $60) for the 2019 tax year. In order to file Schedule C with H&R Block, you’ll need to upgrade to the Self-Employed option, which costs $104.99 for a federal filing.

On the whole, then, H&R Block is cheaper than TurboTax. The lower prices can be misleading, though. You may need to upgrade to a more expensive plan to file certain forms through H&R Block. This is especially true if you have any income from freelance work, contract work or any other where payroll taxes weren’t removed.

If price is your primary concern, you may want to consider a cheaper service like TaxAct. TaxAct is well-known for being affordable but it doesn’t quite provide the same level of simplicity and educational material that these two services offer.

H&R Block vs. TurboTax: Comparing Free Options

TurboTax’s Deluxe option is the more comprehensive option for the average filer, but let’s briefly consider the free options again.

H&R Block and TurboTax both offer a free option for filers with simple returns. You can often use those options if you don’t own a home, you have no investment income other than simple dividends or interest and you don’t have rental properties or business expenses.

You cannot use either form if you itemize deductions. However, there are a few deductions available with the free plans. Notably, you can claim the EIC and Additional Child Tax Credit. H&R Block also includes Schedules 1 through 6, unlike TurboTax.

So if your finances are simple, the biggest consideration is exactly what forms you need to file, because H&R Block includes more forms and schedules with its free plan.

H&R Block vs. TurboTax: User-Friendliness

H&r Block Or Turbotax 2019

Both of these services are known for their ease of use but TurboTax is generally the more user-friendly of the two – whether you’re talking about mobile or desktop.

TurboTax’s interview-style approach will guide you through the filing process with simple and straightforward questions. There is minimal tax jargon. H&R Block is also user-friendly but its questions and explanations are not always as clear as you would hope.

The filing process with TurboTax also includes encouraging phrases throughout. This isn’t a necessary feature, but taxes are stressful for many people. Seeing, “You can do this,” throughout the process may help to reduce some anxiety.

Another important consideration is how easy it is to upload documents. Both services do well on this front. H&R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used (as long as you have a PDF version of the return). They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you don’t waste time retyping everything.

The Bottom Line

So, who wins? Well, it depends what exactly you’re looking to do. H&R Block covers more filers with its free option. The two Deluxe options are $15 different (H&R Block’s is cheaper) but TurboTax’s Deluxe option supports more forms that self-employed, freelance and contract workers may need. Both services are user-friendly but TurboTax is slightly simpler with more straightforward language.

Beyond these factors, which tax filing service you choose may come down to personal preference. Some people prefer one over the other because they simply like the way it looks. They might also choose H&R Block so they can have the option of filing at a physical location.

Of course H&R Block and TurboTax are not the only two tax filing services. You may want to consider other options like TaxAct or TaxSlayer if you’re looking for a budget option. Credit Karma also allows you to file entirely for free.

Tips for Choosing a Tax-Filing Service

- Tax season is a good time to take stock of your overall financial picture. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- TurboTax and H&R Block are two of the most well-known tax-filing services. There are other great services to consider, though, so make sure to shop around. Check out our list of the best tax filing software, as well as the best free online tax software.

Photo credit: ©iStock.com/AndreyPopov, ©iStock.com/Xesai, ©iStock.com/mediaphotos

How do we keep this site running? This post may contain affiliate links, for which we may receive a referral fee. The cost is the same to you and any compensation we may receive does not affect our reviews or rankings. Thanks!

Which Version of H&R Block Do You Need?

H&R Block Online Editions:

Nothing to install, complete your return online. Start for FREE, pay when you file.

Free Online

Best if you have a W-2, have kids, and rent

$0 Fed. $0 State. $0 File.

File for $0

1 federal & 1 state e-file included

Deluxe Online

Most Popular

Best for homeowners, donations, HSAs$49.99 $37.49

Start for Free

1 federal e-file. State additional.

Premium Online

Freelancers, contractors, investors$69.99 $52.49

Start for Free

1 federal e-file. State additional.

Self-Employed Online

Turbotax Vs H&r Block Software

Best for self-employed & small business$104.99 $78.74

Start for Free

1 federal e-file. State additional.

H&R Block Desktop Editions:

Install on Windows or Mac. E-file up to 5 federal returns.

Basic Tax Software

Simple tax returns$29.95 $19.47

Buy Now

5 federal e-files. State additional.

Deluxe Tax Software Most Popular

Best for Homeowners or investors$54.95 $35.72

Buy Now

5 federal e-files. 1 state download included.

Premium Tax Software

Self-employed or own rental property$74.95 $48.72

Buy Now

5 federal e-files. 1 state download included.

Premium & Business

Personal & small business income and expenses$89.95 $58.47

Buy Now

5 personal federal e-files & 1 state download included. Unlimited business returns included.

Save 35-50% off select versions of H&R Block Tax Preparation Software

The Tax Filing Deadline is Wednesday, April 15, 2020.

H&R BLOCK 2019-2020 COMPARISON CHART – COMPARE PRODUCTS AND PRICES

This comparison chart is for the desktop versions of H&R Block . This is software that you download and install on a PC or Mac. Check here for the online version of H&R Block.

| Basic PC or Mac | Deluxe PC or Mac | Premium PC or Mac | Premium & Business (PC only) | ||

|---|---|---|---|---|---|

| List Price | $29.95 | $54.95 | $74.95 | $89.95 | |

| $19.47 | $35.72 | $48.72 | $58.47 | ||

| $19.99 | $44.99 | $54.99 | $69.99 | ||

| $14.99 | $39.99 | $59.99 | $74.99 | ||

| Compare Features | |||||

| NEWDrag & drop personal return from last year | |||||

| Available for PC or Mac | |||||

| FREE unlimited advice from tax experts | |||||

| 5 federal e-files included | |||||

| Guaranteed Maximum Refund | |||||

| Import last year’s tax data from H&R Block and TurboTax | |||||

| FREE in-person audit support | |||||

| Includes Affordable Care Act forms and guidance | |||||

| Itemize deductions with Schedule A | |||||

| Includes 1 state tax return preparation FREE ($39.95 value) | |||||

| Homeowners & Investors | |||||

| Mortgage and real estate deductions | |||||

| Figure out value of charitable donations | |||||

| Guidance on investment income | |||||

| Self-employment & Rental Property | |||||

| Guidance on home sale | |||||

| Deductions for self-employement income (Schedule C) | |||||

| Help with rental property income and expenses (Schedule E) | |||||

| Small Business | |||||

| Prepare return for corporation, s corp, partnership, LLC, estate, trust, non-profit | |||||

| Produce W-2s, 1099s, and other payroll and employer forms | |||||

| Vehicle tax deductions | |||||

| Maximize business expense deductions and asset depreciation | |||||

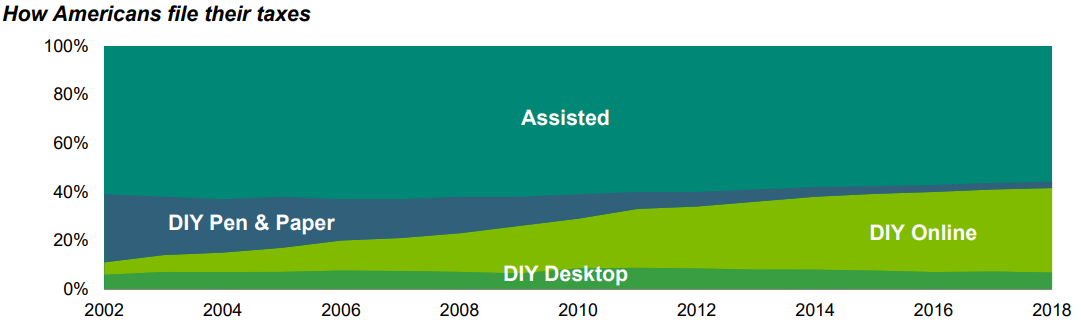

The comparison chart above is for the H&R Block desktop versions. H&R Block desktop tax preparation software is designed for do-it-yourselfers who want to complete their own return. The software installs on a PC or Mac, then will walk you through completing your return by using a step-by-step questions & answer format to guide you on more than 350 credits and deductions. You can import W-2s, 1099s, 1098s, and last year’s tax return. You can even import from TurboTax and Quicken.

All versions of H&R Block desktop will allow you to efile up to 5 federal returns and all versions allow you to itemize deductions with a Schedule A. Each version also includes free tax advice from real people via online chat and free in-person audit support if you ever get an audit notification from the IRS.

Each desktop version (except Basic) includes one state tax preparation program, a $39.95 value.

Save on H&R Block online edition

H&R Block online versions work through your web browser. Instead of installing a program on your computer, you just log in at hrblock.com and start or continue working on your return. Everything is saved in the cloud and is protected by bank-level encryption technology. This is a great option for people who don’t want to install another program on their computer and who don’t want to worry about keeping a backup of their information. H&R Block online will take care of keeping your data safe for you.

H&r Block Software Vs Turbotax

We recommend the online versions of H&R Block as the best value for anyone who does not need to file a state return. If you do need to file a state return or multiple federal returns, the desktop versions of H&R Block shown in the comparison chart above are usually a better value.

Right now you can get H&R Block online versions for up to 25% off the regular price.

H&R Block Desktop Editions

Basic Tax Software

Simple tax returns$29.95 $19.47

Buy Now

5 federal e-files. State additional.

Deluxe Tax Software Most Popular

H&r Block Tax Software Vs Turbotax Mac 2018

Best for Homeowners or investors$54.95 $35.72

Buy Now

5 federal e-files. 1 state download included.

Premium Tax Software

Self-employed or own rental property$74.95 $48.72

Buy Now

5 federal e-files. 1 state download included.

Premium & Business

H&r Block Tax Software Vs Turbotax

Personal & small business income and expenses$89.95 $58.47

Buy Now

5 personal federal e-files & 1 state download included. Unlimited business returns included.